Understanding the costs of buying a house in Ottawa is critical and a buyer needs to prepare for them. There is more to think about than just your mortgage. Here is a list of other costs to consider:

1) Deposit - While a deposit is negotiated between the buyer and the seller, 1-5% of the purchase price is an average deposit here in Ottawa. The deposit is due within 24 hours of an accepted agreement of purchase and sale and is held in trust by the real estate brokerage.

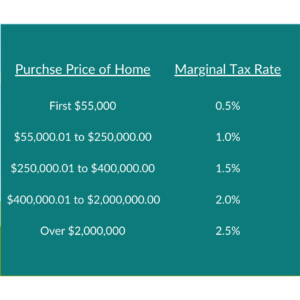

2) Land transfer tax - This tax is paid by the buyer every time you buy a home.

Here is a calculator to make it easier Ontario Land Transfer Tax Calculator.

3) Legal Fees

You need a lawyer to ensure that your property closes and ensure all legal and financial obligations are met. In addition, they review the agreement of purchase and sale, check for liens against the property, ensure that the property taxes are paid, ensure that you have valid title and arrange for title insurance.

4) Appraisal Fees

In order to protect the money they lend to you, some lenders will require an appraisal prior to the closing date. While some lenders pay the cost of this service, you should be prepared to pay the fee upfront. It is typically between $500-$600.

5) CMHC Mortgage Loan Insurance

Purchasing mortgage loan insurance is required when you buy a home with less than 20% down and under $1,000,000. See how to calculate the amount here:

CMHC Mortgage Insurance Calculator

6) Inspections

A buyer can negotiate a home, septic, well and wett inspections in a purchase and sale agreement. Each inspection could be $500 or more.

Need advice? Give me a shout!